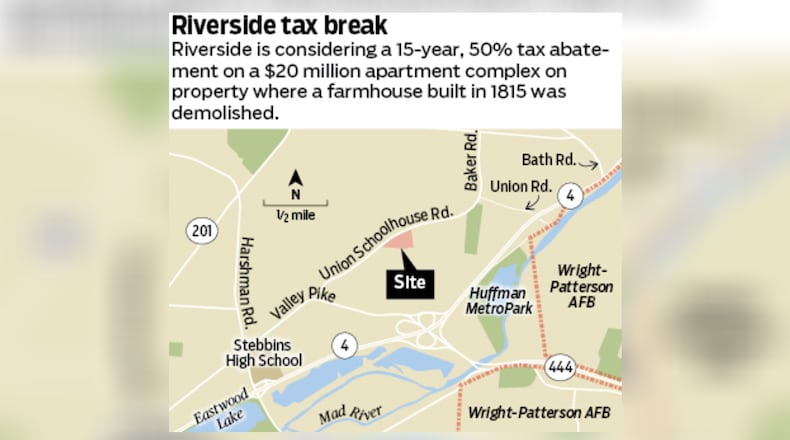

The 90-unit Redwood Living complex is being built on about 18 acres in the Fairborn City School District near the Dayton corporation line and Wright-Patterson Air Force Base, according to city records.

The project is in Riverside’s Northern Community Reinvestment Area, city records show. A CRA allows property tax exemptions for residential and commercial property owners renovating existing structures or constructing new buildings, according to the city.

“Proportionate to the level of investment that the company is making in the project … the amount that they’re receiving from this (agreement) is appropriate,” Riverside Mayor Pete Williams said. “I think it’s a good investment on our end because of the investment that we’ll see as a city.”

The project is expected to include 300 jobs during construction and more than $1.3 million in infrastructure, but create only two permanent jobs, council’s legislation states.

It includes widening a portion of Union Schoolhouse Rood and adding “stormwater infrastructure needed for that entire project,” Williams said.

The complex will be privately maintained, “so there’s not a large amount of things that the city is on the hook for,” he added.

Work is expected to start this April with all acquisition, construction and installation to be complete in April 2027, the CRA agreement states.

“If council grants the incentive, the city would provide approximately $310,000 to the developer over the course of the … agreement,” a memo from Riverside City Manager Josh Rauch and Community Development Director Nia Holt states. “This is less than half the cumulative cost to make the road and infrastructure improvements in that area, which are estimated at $700,000.”

If approved by council, after the development is completed, the annual total property taxes are projected to be about $400,000, according to the city.

Credit: JIM NOELKER

Credit: JIM NOELKER

Of this, Riverside would receive about $41,000 in property taxes annually before any incentives are applied, officials said. As with any property, other recipients of the parcel’s $400,000 in property tax would include the public school district, county human services, Dayton Metro Library and others.

City council approved a zoning change for the complex last year in a 3-2 vote despite resistance from many residents.

Aside from being against tearing down the 19th century farmhouse, opponents raised concerns about increased traffic, the density of the housing, and its impact on underground springs and waterways.

Redwood is an Independence, Ohio firm. It has properties in Centerville, Fairborn, Sugarcreek Twp., Tipp City and Washington Twp. with sites under construction in Miamisburg, Troy and Vandalia, Redwood executive Greg Thurman has said.

About the Author